|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

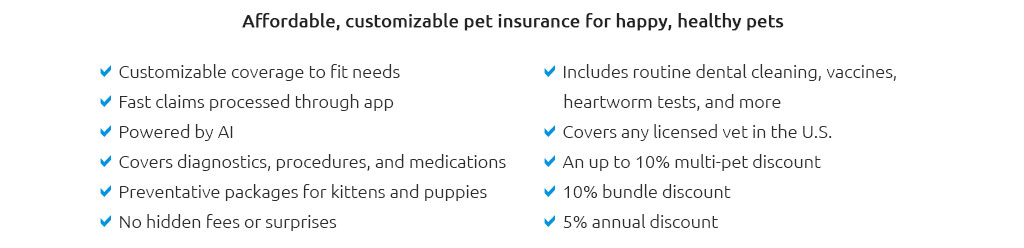

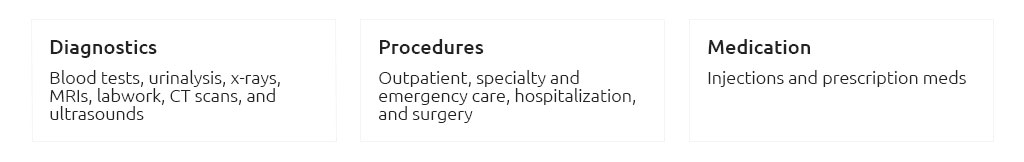

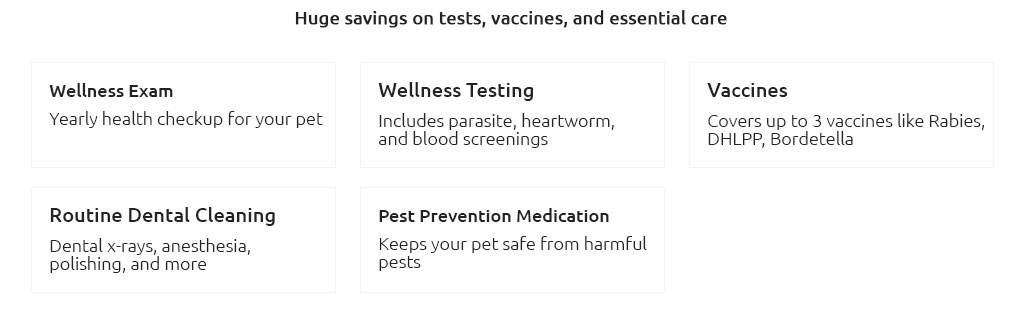

Pet Insurance Reviews Comparison: Key Insights and ConsiderationsAs more pet owners consider the benefits of insuring their furry companions, the need to compare pet insurance reviews becomes increasingly important. Understanding the nuances of various insurance plans helps in making an informed decision. Understanding Pet Insurance BasicsWhat Does Pet Insurance Cover?Typically, pet insurance plans cover accidents, illnesses, and emergency treatments. Some plans may also offer wellness and preventive care.

Types of Pet Insurance PlansUnderstanding the types of plans available can greatly influence your choice.

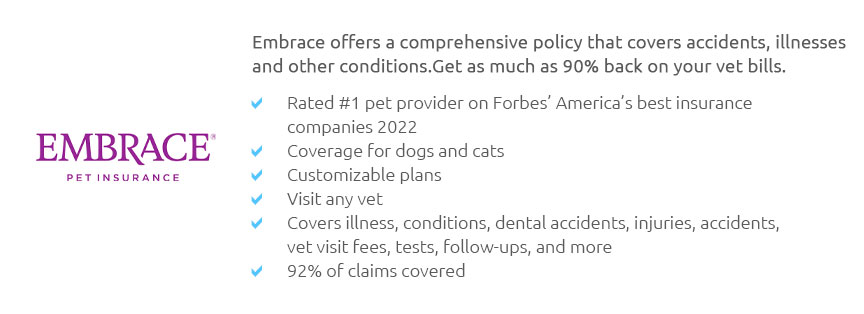

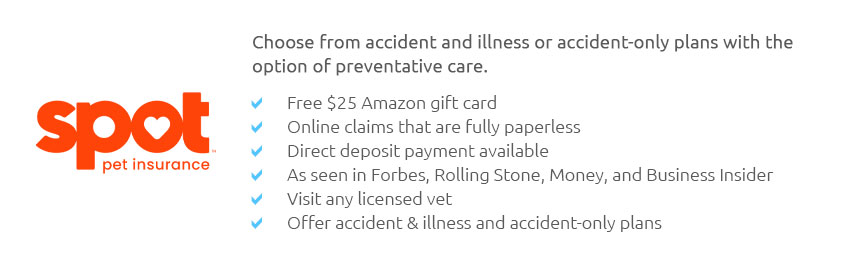

Comparing Pet Insurance ProvidersTop Providers in the MarketSeveral companies stand out for their reputation and coverage options.

For those living in specific regions, such as pet insurance jacksonville fl, regional reviews can provide additional insights. Pros and Cons of Popular PlansEach insurance provider has its strengths and weaknesses.

How to Choose the Right PlanChoosing the right pet insurance involves evaluating both your pet's needs and your financial situation. Consider factors like premium cost, deductible, and reimbursement rate. For pet owners in urban areas, checking local costs, such as pet insurance las vegas cost, can also be insightful when budgeting for insurance. Factors to ConsiderKey factors in selecting an insurance plan include:

Frequently Asked Questions

https://www.businessinsider.com/personal-finance/pet-insurance/best-pet-insurance

Best for Chronic Conditions: Trupanion Pet Insurance - Best for 100% Reimbursement: Figo Pet Insurance - Best for Exotic Pets: Nationwide Pet ... https://www.trustpilot.com/categories/pet_insurance_company

Recently reviewed companies ; Fetch Pet Insurance - 4.4 - 4,273 reviews ; Nationwide Pet Insurance - 4.3 - 693 reviews ; Embrace Pet Insurance - 4 ... https://wagwalking.com/wag-wellness/pet-insurance

Uncomplicate picking your pet insurance with Wag! Wellness. Compare top pet insurance providers to see what's covered, cost, health expenses, reviews, ...

|